New Fund Alert: The Quantified Eckhardt Managed Futures Strategy Fund Launches

Learn More

Develop the best product for you. Our experienced team will guide you through investment strategy, naming convention, expense and share class structures, placement strategy, and more.

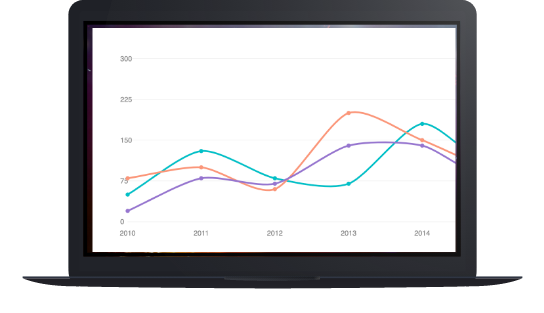

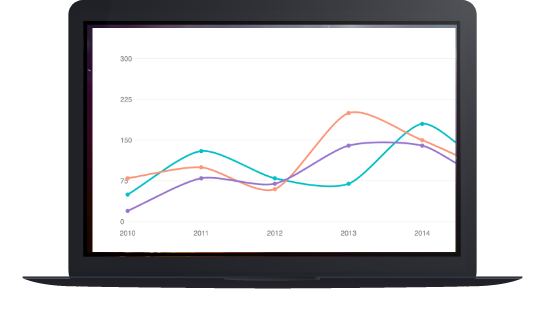

Gain insight into the marketplace and competitors. Take advantage our suite of technology tools that provide invaluable information illustrating industry trends and analyzing competing products.

Optimize product availability. We’ll guide you through the maze of platforms and programs, their requirements and costs, including Blue Sky considerations. Leverage our 100+ selling agreements where applicable.

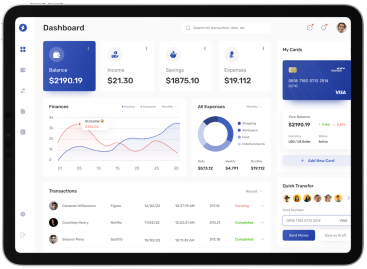

Identify and track your clients and asset flows. Gain transparency of asset growth and client activity via an industry leading system made available to you.

Execute with confidence. Our affiliated trade desk can implement your strategy using advanced methods and systems.

Develop the best product for you. Our experienced team will guide you through investment strategy, naming convention, expense and share class structures, placement strategy, and more.

Gain insight into the marketplace and competitors. Take advantage of our suite of technology tools that provide invaluable information illustrating industry trends and analyzing competing products.

Optimize product availability. We’ll guide you through the maze of platforms and programs, their requirements and costs, including Blue Sky considerations. Leverage our 100+ selling agreements where applicable.

Identify and track your clients and asset flows. Gain transparency of asset growth and client activity via an industry leading system made available to you.

Execute with confidence. Our affiliated trade desk can implement your strategy using advanced methods and systems.

Focus on your core business. Acting as the sub-advisor, you are less burdened of most the day-to-day administrative duties to effectively operate a fund.

Operate with confidence. Concentrate on your core competency, money management. Our highly capable team will take the lead on all other operational matters including regulatory, compliance, tax, reporting, and more.

Selling agreements and materials review done hassle free. Lean on our affiliated team to execute selling agreements and provide fact sheets, pitch books, websites, and more.

Our tenured team of compliance professionals and partners will oversee the daily and ongoing requirements as well as keep an eye on future regulatory developments.

Save costs and speed up time to market. Take advantage of expenses that can be spread across multiple funds to contain costs. Shared Trusts are also able to launch funds more expeditiously than typical stand-alone trusts. You’ll also have an opportunity to interact directly with our directors.

Focus on your core business. Acting as the sub-advisor, you are less burdened of most the day-to-day administrative duties to effectively operate a fund.

Operate with confidence. Concentrate on your core competency, money management. Our highly capable team will take the lead on all other operational matters including regulatory, compliance, tax, reporting, and more.

Selling agreements and materials review done hassle free. Lean on our affiliated team to execute selling agreements and provide fact sheets, pitchbooks, websites, and more.

Our tenured team of compliance professionals and partners will oversee the daily and ongoing requirements as well as keep an eye on future regulatory developments.

Save costs and speed up time to market. Take advantage of expenses that can be spread across multiple funds to contain costs. Shared Trusts are also able to launch funds more expeditiously than typical stand-alone trusts. You’ll also have an opportunity to interact directly with our directors.

See how Advisors Preferred can help power your practice by leveraging our Fund expertise - we'll show you the way